Services For Employers

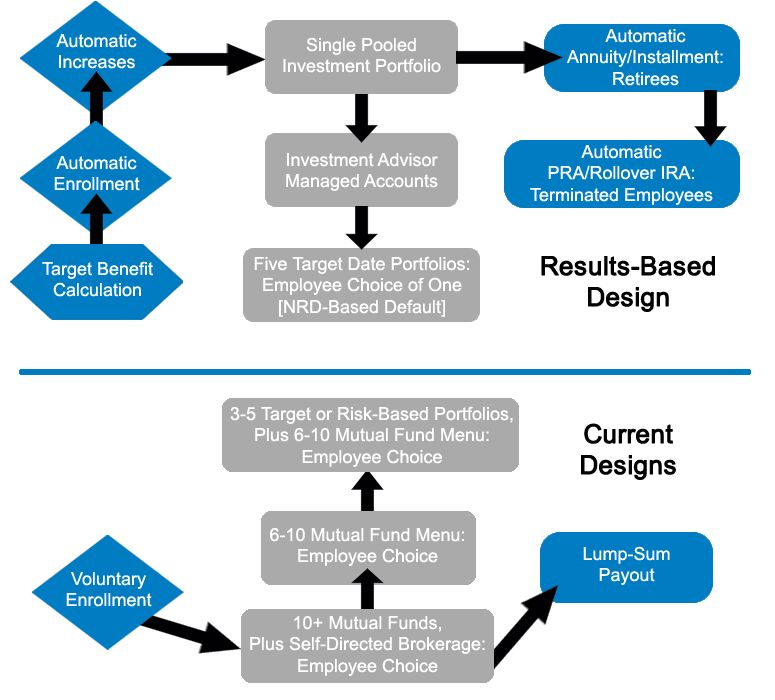

Plan Design

One of the most important components of driving plan efficiencies is spending time on Plan Design. We sit down with you to fully understand your end-state, and then design a retirement plan that assures your employees will have the clearest path to financial wellness, and to the greatest extent possible, reduce your administrative responsibilities.

Specific areas we focus on include:

- Employer contribution strategies

- Evaluation of qualification and eligibility issues

- Compliance with legislative changes

- Support services to help simplify plan administration

- Optimal use of safe harbors such as 404(c) and QDIA

- Comparative-analysis studies to determine the most efficient type of plan to adopt

- Cross-tested 401(k), cash balance, and defined benefit plans

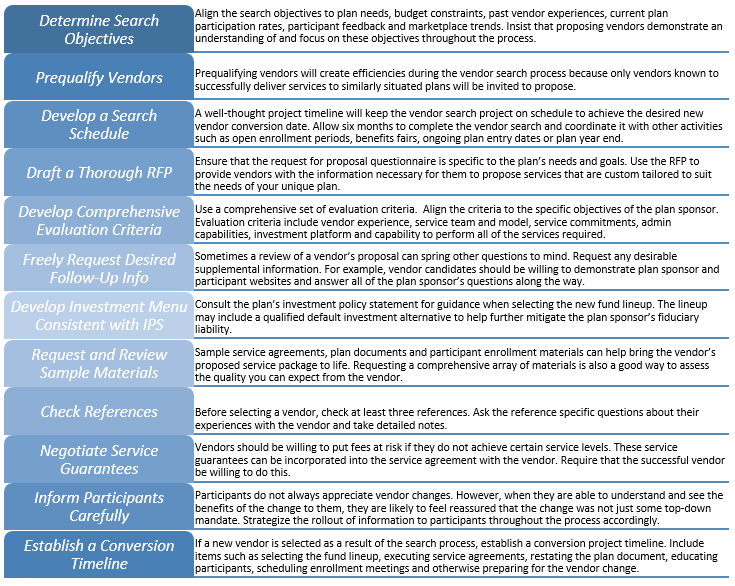

Vendor Monitoring & Evaluation

Since we have no conflicts of interest, we provide professional unbiased advice in your Search Process. We employ twelve best practices when determining the best-fit provider.

Investment Due Diligence

Portfolio Structure – We employ a rigorous methodology to determine an optimal portfolio structure for the plan. We then stress test this portfolio under multiple adverse market conditions. This enables us make adjustments to the optimal portfolio to account for factors not captured by traditional risk/return analysis.

Manager Analysis – We also conduct a comprehensive investment analysis of managers weighting a broad range of factors into our proprietary model. In addition, we implement an extensive qualitative review of the managers to determine which managers meet our highly selective criteria.

Investment Selection – We construct an investment offering tailored to your needs. We conduct a comprehensive investment analysis weighting a broad range of factors into our proprietary model. In addition, we implement an extensive qualitative review of the investments to determine which funds meet our highly selective criteria.

Ongoing Reporting – We produce a Quarterly Monitoring Report that analyzes the plan’s investments based on the specific criteria we help you identify in your Investment Policy Statement (IPS).

Regular Plan Benchmarking

We analyze total plan costs and ensure that the fees are fully disclosed, reasonable and efficient. We also analyze and quantify any revenue sharing arrangements. We negotiate lower share classes for Plan Sponsors.

Annually, you will know exactly how your plan stacks up with the competition in your industry on multiple levels:

- Plan Design

- Plan Participation

- Employee Education

- Investment Performance

- Plan Costs

- Administrative / Recordkeeping Fees

- Advisor Fees

Fiduciary Services

Design & Implement Investment Policy – We write an Investment Policy Statement and proactively address the content with you annually.

Fiduciary Education and Training – We have specialized training and accreditations as an AIFA® (Accredited Investment Fiduciary Analyst). We educate Plan Sponsors of their fiduciary duty and best practices in being a fiduciary.